I’m the Map

A little drawing exercise

I think knowing where your money is going is step 1b towards alleviating the stress that finances bring (1a is knowing why you think about money the way you do, coming in a future post!). Start by putting your money “map” in a spreadsheet, Visio flow, or drawing on a piece of paper in order to get yourself a visual of what’s going in your bank account and what’s going out every month. I saw this idea in a Money with Katie article and thought I’d try it out. Wherever your skills may lie, this is a great exercise. I also think it can be a great refresher for those of us who feel we know where every dollar is going — like yours truly.

Now, it can get overwhelming to think about all the goals we have for our money. When thinking about the accounts, percentages, dates, bills, gifts, donations, etc., it’s easy to give up on trying to actually understand your financial situation. But, you’re a reader who wants to get ahead of this anxiety and have a plan! That’s where the map can help.

My wife (Kelsey) and I are DINKs, which for those of you who are very confused by this term, means Dual Income No Kids. So, this means twice a month payday comes, and from then on there’s a series of transfers, payments, and the hope that there’s a little leftover for a Lulu trip (or a restaurant splurge if you’re Kelsey). We have 401Ks through work, three savings accounts, Roth IRAs, and three brokerage accounts. Just typing that seems like a lot, and it’s not for everyone. But, it works for us right now. That doesn’t mean we won’t consolidate in the future, or heck— add another account to our list. I’m a personal finance nerd, so I’m always looking to test different strategies. Regardless, mapping out your flow of money can help if you have an account with multiple banks, or just one checking and savings account. You might do this exercise and realize you need to manage your money in a simpler way. Or, alternatively, you might come to understand that you actually had no idea where your money was going and now realize why that checking account looks so great on payday, and so sad at the end of the month. Either way, this is the first step towards not having to worry about money.

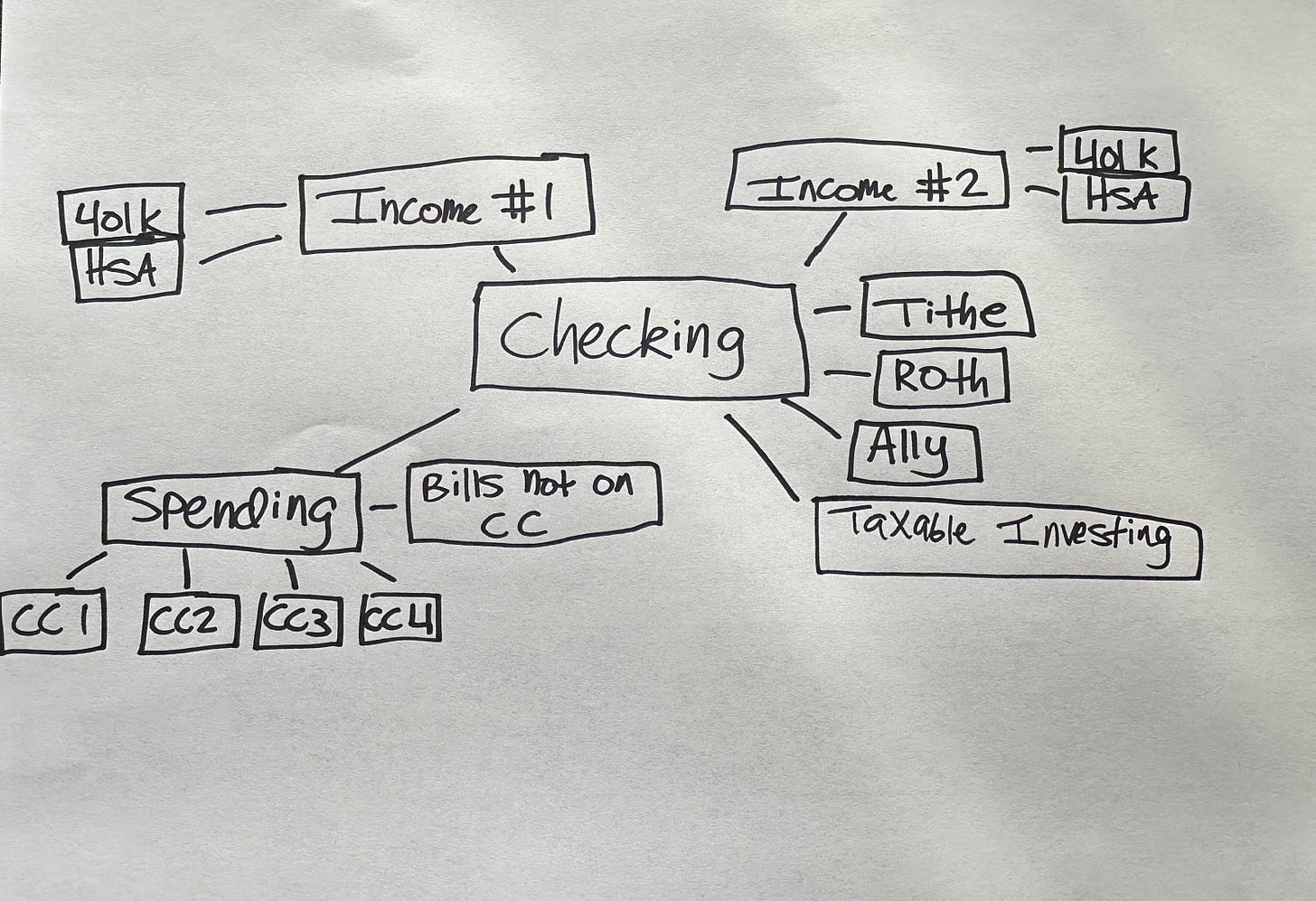

With that being said - here’s a look at our own money map:

Here’s how to read it:

Everything starts with the checking account. That’s the mouth of the river and where everything flows. We have a joint bank account, so both paychecks going to the same checking account. We get paid on the 15th and last business day of each month.

Before that direct deposit hits, we have percentages of our paycheck contributing to our 401K (might be time to check that you’re at least getting that employer match, if you have one). We also contribute to other things that are deducted from our paychecks before it deposits into our checking account, such as HSAs, or Health Savings Accounts.

After the direct deposit hits our checking account, I transfer to our savings accounts, our brokerage of choice for taxable investing, and have an automatic transfer for our Roth IRA. Now, if you’re hands-off and don’t want to think about it, I recommend you auto-transfer for all of these things. However, we’ve been toying with how much to contribute to our savings and taxable brokerage, hence the manual transfers we’re currently doing. Once we find a comfortable spot, auto-transfer will be turned on. Pro tip: I recommend setting up these transfers for a day or two after payday, just to ensure everything hits your account prior to correctly, and that you don’t overdraft.

We then tithe from our checking account to our church.

Then the fun begins - Bills. I have all of our bills set to autopay with our credit cards. For the bills that can’t be on a credit card (think rent), I ensure that money is in our checking account. This is also where having awareness of where your money is going helps, because there isn’t anything worse than the 1st of the month coming and there’s a large overdraft and an unhappy landlord calling you.

Next, I pay our credit cards in full each paycheck. This isn’t necessary, I just like doing it to have a fresh start with each payday. Note: you should be paying your credit cards in full each month to avoid interest. These credit card payments also come from our checking account.

Lastly, I transfer any leftover money from the checking account to a brokerage account for taxable investing in Index Funds. I’ll do a future article on the funds I chose and why, but for now, know this is the last step for a reason. All retirement accounts should be prioritized first, and contributed to as much as possible — ideally maxed out if you can. A quick order of operations for investing would be: 401K up to the employer match, max a Roth IRA, contribute more to the 401K, an HSA, and finally a taxable brokerage.

Now, you might be asking, “Zane, it’s great that you can draw a map. But, how do you actually track all of this?” Well, there’s a couple ways this can be done. I’m a very hands-on finance person, so I use a Google Sheets with a tab for the current month. This spreadsheet lists the balances for our checking account, credit cards, and what would be left in our checking after we pay off the cards. This is a very involved approach, but works for me and may work for you if you also like to be in the weeds. Here’s a link to a Google Sheets template I created that you can use for your own personal spending. You can download it to Excel, or add it to your own Google Drive.

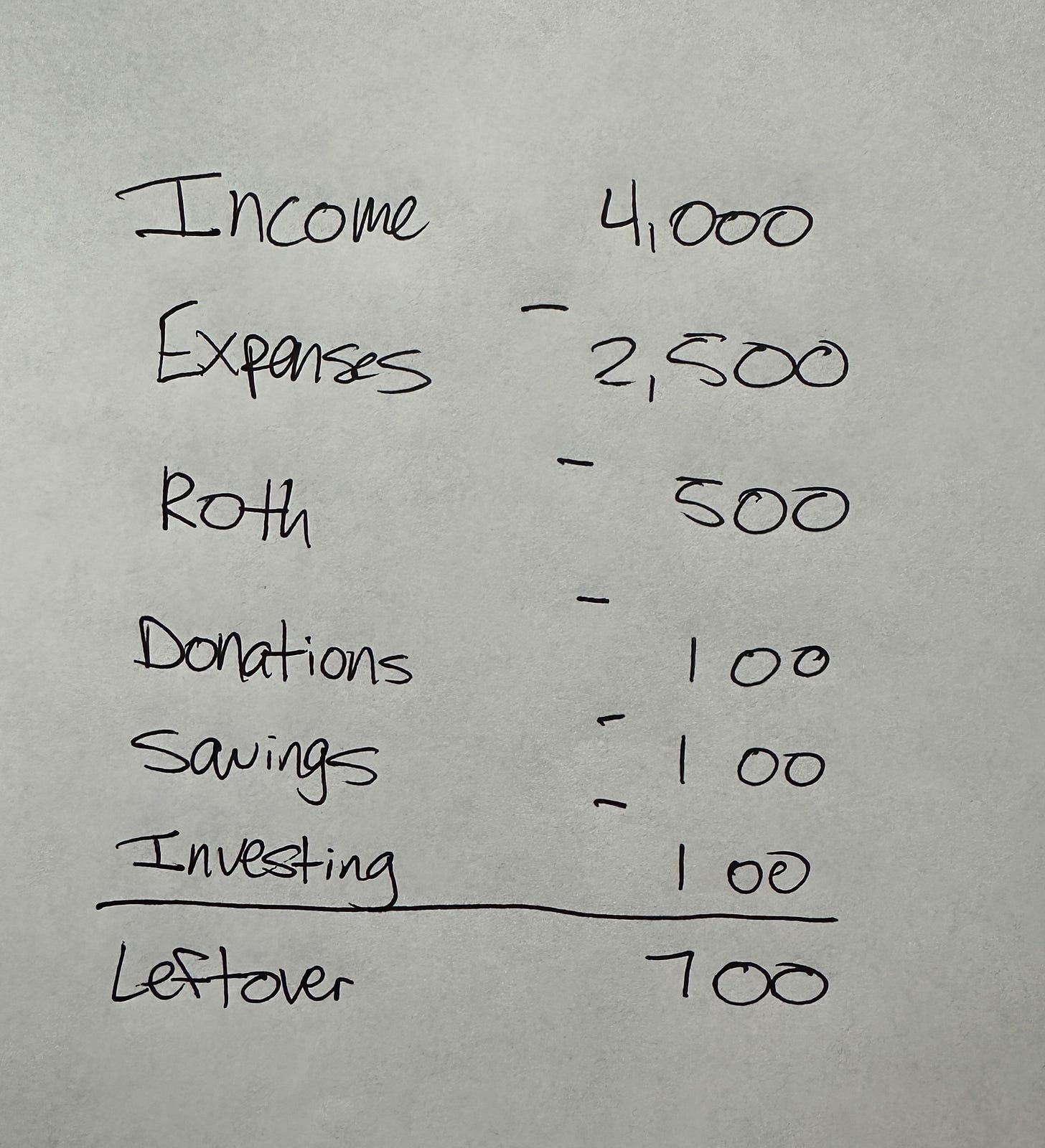

For those of you that are more hands-off, there’s a couple methods. First, there’s the tried and true pen and paper. This is the old school Excel, but many prefer writing things out. For example:

For those who prefer apps, here’s a few that I recommend (and I’ve used all of these): Copilot, Mint, and YNAB (You Need A Budget). These are all great software tools to use and can also help keep you on track with your finances. One of these will likely meet your needs and Mint is free, which is always a perk. Both Copilot and YNAB have free trials, so don’t shy away from taking advantage of that either. Personally, after a few months of testing each of these myself, I realized I like the Google Sheets method.

On a high level, this exercise gives a visual to figuring out how much money you have, or do not have, at the end of each month. Essentially, it’s showing you your income minus bills, savings, investing, donations, and other spending. I think this is where the spreadsheet or pen and paper really help if you don’t like what you see, or have various goals you want to meet.

Another way of looking at it is in percentages. When it comes to percentages devoted to each category of your life (investing, saving, spending), there’s plenty of ways to break it down. The classic is the 50/30/20 rule, which says 50% of your income should go to needs, 30% to wants, and 20% to savings. It’s a great start for someone new to managing their money. However, there is no hard and fast rule when it comes to your money. It is, after all, your money! I don’t try to stick to percentages anymore, as I found it restricting. Rather, I just want to increase my savings and investing rates as our income goes up. Finding the right balance is difficult, and comes with figuring out new ways to managing your money — but you can find it.

But, if you want to see our percentages, here they are based off of our pretax income to account for the 401K contribution:

Investing (Retirement and Taxable) - 19%

Saving - 15%

Spending - 59%

Tithe - 7%

The above are not recommendations, but how our current finances are broken down

As I said earlier, mapping out your money is a great way to see where you currently stand and is the first step to mapping out where you want to be. It might also reveal where you’re spending that you might not have been aware of.

Everyone has their own unique way of managing money. Please comment down below with any questions you might have on mapping or anything else mentioned here. Thanks for reading!