Saving and investing. Two things we hear about all the time are often bundled together. Are they the same thing? Should you do both? What happens if I only do one? Just a quick google search of “saving vs. investing” reveals a litany of articles, only adding to the confusion. Well, you’re not alone.

When I started getting interested in personal finance, this was one topic that confused me the most. I was always searching the internet, reading as many articles and books as I could, and listening to podcasts to find the real difference between these two important words. Let’s start with savings.

I assume most of us have heard about saving money, or at least the word save. Traditionally, saving means storing away for later. That could be retirement, or that Birkin bag you’ve been eyeing (even though the current rate of inflation may be causing you to look the other way). Either way, you’re saving your hard-earned dough for a future use. Where it gets tricky is where to put what money for what purpose.

Before we begin to deep-dive into the saving vs. investing question, one must do two things:

Have an emergency fund of 3-6 months of expenses, maybe even up to one year if you can make that happen in your budget. The amount you save will depend on your risk tolerance and how volatile your line of employment is. Keep this liquid and in a High-Yield Savings Account - I recommend Ally. These expenses should be your core expenses (think rent, utilities, food, gas, child costs, etc.). If it’s non-essential, it shouldn’t go into your emergency savings. In other words, your Netflix subscription doesn’t apply here, because if things get rough, Netflix-and-Chill has gotta go.

If you have one through your employer, contribute to your 401K enough to get the employer match. This is free money added into your retirement by your employer, and is the easiest way to get a jump start on your retirement goals— just watch that baby compound over the years of hard work that you do for your company!

Now, with that out of the way, we can start our deep-dive.

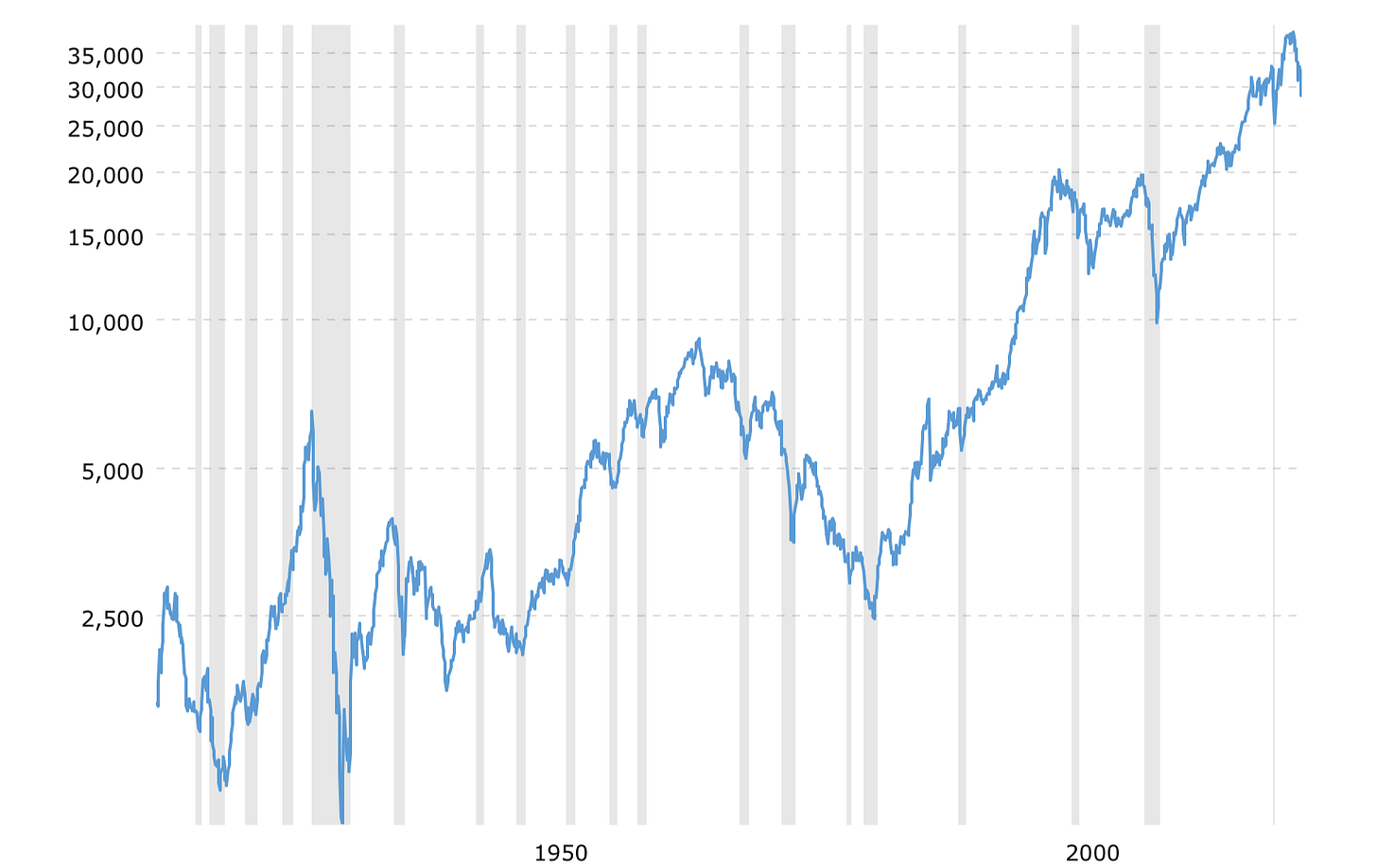

Let’s discuss investments first. If you couldn’t tell from tip #2 above, I believe planning as soon as you can for retirement is important. You might view this as saving, but actually — it’s also investing (see the confusion?). You might be doing this already and haven’t realized it. When you get a new job, most employers offer you the ability to set up a 401K that you can contribute to. These paycheck contributions are being invested into various stock funds (again: take advantage of the employer match!), which grows exponentially over time and will turn into your income when you reach your desired retirement age. Consistent contributions that are automatically taken out before your direct deposit hits are critical to building wealth. That’s why the stock market truly is not just for the “rich”, as you may hear from our politicians— but is also for the common, everyday worker. That’s what makes it so great! And better yet, the compound growth is real and survives economic downturns. Don’t believe me? Check out this graph. The stock market has always trended upward over time.

Another key element to the investing formula is the Roth IRA. As long as you fall below the income limits, this is a must. You can contribute up to $6,000 per year ($12,000 if you open one for a spouse), and when you begin withdrawals after age 59.5, this income is tax-free! For 2023, you will be able to contribute up to $6,500 per year. My wife and I have $500 contributions auto-deposited monthly into a Roth IRA through Vanguard, though you can lump-sum $6,000 all at once if you choose. I chose a target-date retirement fund to invest into, which automatically rebalances over time as you near your retirement age. This means that as we get closer to retirement age, our fund will consist of more bonds (low risk) than stocks (higher risk). As I expect us to retire around 2060, we have the 2060 target-date retirement fund. This is easy to set up, and if you do auto-deposits, you never have to think about it until you retire and use that sweet, tax-free, money you invested.

Now, let’s discuss savings. If retirement is the marathon, then savings is the 5K, 10K, or even the half-marathon, depending on when you need this money. When it comes to savings, the emergency fund should be your #1 savings goal, as I mentioned above. After you have this, any extra savings are a great way to reach your nearer-term goals. This is like when you were younger and saved money from the allowance your parents may have given you, or by mowing lawns, to buy that cool Xbox game. Except, now you pay taxes (you can still buy cool Xbox games though). Typical things to save for here are vacations, large electronics, a car, or a down payment for a house. To me, anything you need under 5 years should be in a High-Yield Savings Account to best shield against risk, as opposed to investing this money in a stock market account. I still prefer Ally for short-term/emergency savings goals, as they have a great feature that allows you to create savings buckets. You can name them and then move money into each one. It’s super motivating to see these buckets grow, and allows you to separate your money more efficiently.

At this point you might be wondering when you can buy the stock picks your second-cousin told you about that will make you rich. However, I’m going to say something that may sound controversial. If you’re already doing the things I mentioned above, and you have leftover income, it’s time to go back to your 401K and contribute more. If you can max out your 401K (contribution limit is $20,500/year and goes up to $22,500 in 2023), then I highly recommend you do so. Again, compounding is king. But, if after all of this you still have money left, then I think opening a brokerage account and investing into index funds is great. Though not recommended by many personal finance gurus, I like the brokerage account as a multi-purpose account. I invest any leftover money each month into index funds, with the idea that if we need it, it’s there. If not, it will grow over time and be used down the road as a backup savings account, or even as extra retirement money. Please keep in mind that one of the downsides of having a brokerage account is when you sell, you are taxed. I use Vanguard for our brokerage account, but just started using Betterment for robo-investing (which will be the subject of a future review coming soon).

As you can see, answering the saving vs. investing question isn’t easy, because it’s so individualized. What works for me is viewing each based on when we expect we’ll need the money. In other words, money in our High-Yield Savings Account will be used before our investments. But, the argument can be made that I’m making things too complicated and I should bundle everything as “savings”, and call it a day. However, this is Money Simplified, and I believe knowing the difference makes things more simple to understand and less convoluted, and hopefully will empower you to make the right decisions for your financial situation. Regardless of how you end up defining either, understanding when you’ll likely need your savings is the best way to set yourself up for future success.