I saw a headline on CNBC the other day that said young investors were the leading age group to sell investments right now due to fears of inflation and taking losses in the stock market. After doing a little research, I saw another story that said some millenials and Gen Zers are closing investing accounts due to fears of inflation. My immediate reaction to both of these was the same: why?

I understand how seeing a declining market (the S&P 500 is down 21.93% YTD), rising inflation, and plenty of headlines could scare an investor. But, when you’re anywhere from your mid-20s to early 40s, it makes me wonder why one would panic sell. These are the prime earning years for many, especially in the market. If anything, the market is on sale right now. So, why are people selling?

I think answering this question depends on which viewpoint you think those closing accounts might have. Millennials and Gen Zers are not completely sold on investing for the long run (retirement), with 29% of Gen Zers viewing investing as a means to get rich, compared to 35% viewing for retirement, according to a study done by Magnify Money. 49% of millenials want to use investing to retire comfortably, with 22% wanting to get rich. For comparison, 81% of Baby Boomers had the goal of retiring comfortably through investing, and 2% wanting to get rich.

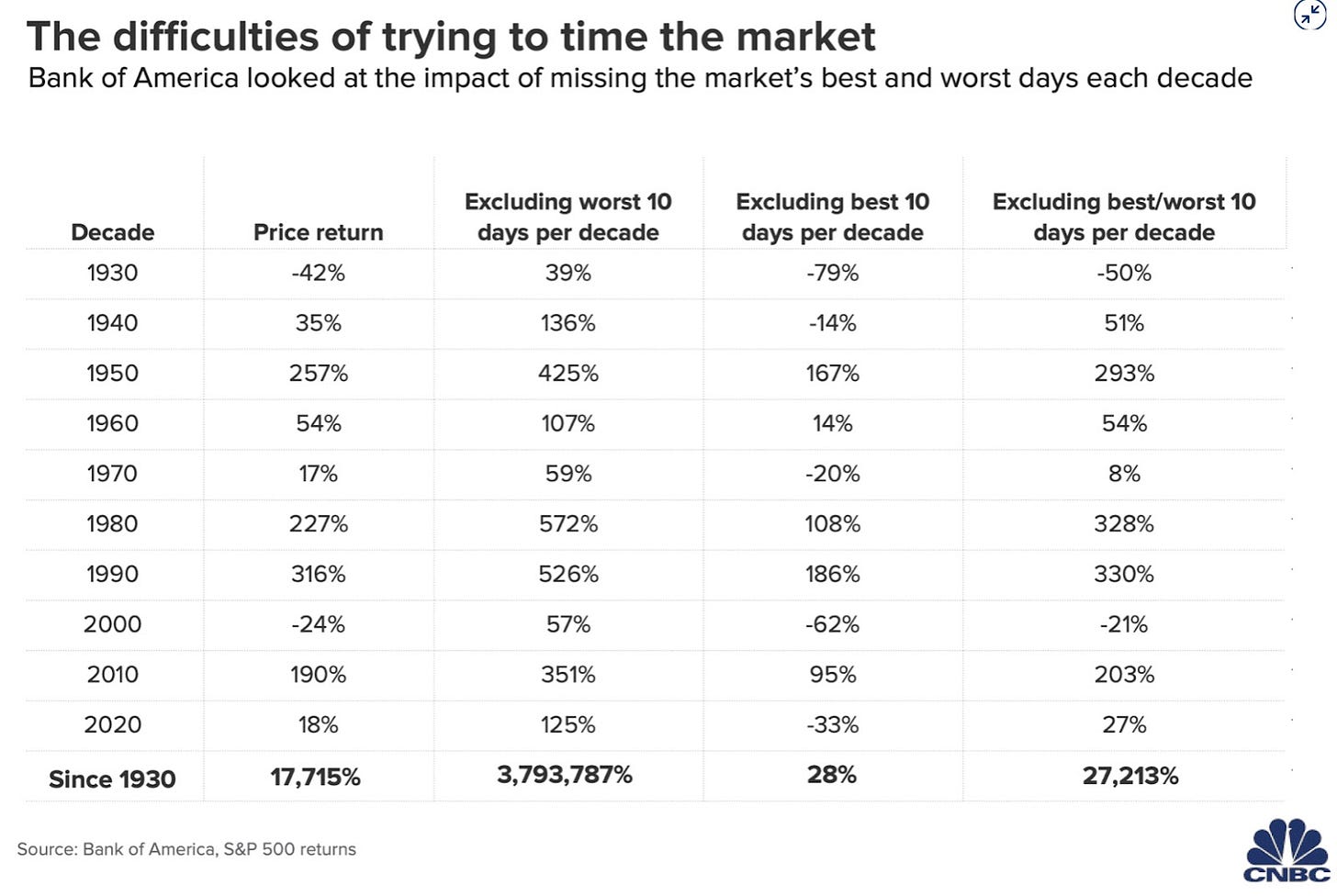

So, here is the double-edged sword: younger people see retirement as being far off, so closing accounts and selling funds isn’t a problem for them. Yet, at the same time, retirement is far off! Holding onto those funds and letting them ride the waves of the market are how you gain wealth. In fact: since 1930 an investor missing the S&P 500’s 10 best-performing days every decade led to a total return of 28%, versus staying invested and netting a return of 17,715%. Past performance isn’t a guarantee for future returns, but that’s a good track record.

If younger generations are selling and leaving the market, and in some cases not returning, what were they buying in the first place that was too risky for their appetite?

A little bit of research shows many younger investors are buying more individual stocks, especially growth and dividend, more so than mutual funds or ETFs (exchange-traded funds). A Motley Fool study found 58% of investors aged 18-40 owned growth and dividend stocks. The same study showed 67% in the same age group owned stocks, while 45% owned mutual funds. While individual growth and dividend stocks can be great in a diversified portfolio, individual stock buying is very risky. Companies in these categories can often be hit the hardest, especially in difficult markets like the one we’re in. This is seen in the S&P 500 Growth Index, which YTD is down 27.61%. Compare that to the overall S&P 500 which is down 21.93%. In this comparison, it seems more likely that investors are buying individual stocks in the growth sector, which is heavily weighted towards tech stocks, as opposed to a S&P 500 index fund.

Now don’t get me wrong. There is always a chance you hit it right and pick the next Apple, Amazon, Tesla, etc. But, the likelihood isn’t high. I’m not saying don’t have individual stocks in your portfolio. However, this is Money Simplified. I want to help make your financial life easier. If you want to have a small percentage dedicated to individual stocks - have at it. But, I do feel that many of us would be better off piling as much money as possible into index funds that track the entire market. Heck, the market is on sale right now! This is the time to “Buy, Buy, Buy!” As WallStreetBets’ favorite friend Jim Cramer would say.

When it comes to why younger investors are selling, Ally conducted a survey and found that the top reason millennials sold was to cover household expenses, with crypto losses, inflation, and the fear of losing money being the following reasons. While concerning that younger investors are even selling at all, the reasoning is also troubling. Using investment accounts for household expenses is a recipe for disaster. There is too much volatility in investing to lean on that to cover monthly costs. A better, less stressful, way to handle monthly expenses is to actually track what you need your money to do for you. This is where money mapping can come in handy (shameless plug).

“There is something to gain from the discipline of consistent investments…”

I think a mindset shift is what is needed here. Everyone wants to gain wealth in some fashion. But, I think we want it all now. We see people online who flaunt their crazy stock picks that paid off (GameStop), wealth gained quickly through crypto, and the ability to have whatever one wants at that time. Consider me old-fashioned, but I think there is something to gain from the discipline of consistent investments over time, dealing with the ebbs and flows of the market, and repeating this process. This is the same idea when it comes to budgeting: knowing how much you’re spending versus how much is coming in, and then spending below your means. There is freedom in that.

So what’s my recommendation you ask? Prioritizing your tax-advantaged retirement accounts before any taxable brokerage comes into play. Look to increase how much you contribute to your 401K. Open, or contribute more, to a Roth IRA. Do you have short-term or long-term savings goals that you could start putting money into a High-Yield Savings Account, like for travel or a down payment on a house? You might even have high interest debt (interest >4%) that you could pay extra towards. These are all things that can come before individual stock picking.

If you are already doing these things, that’s great! If you have leftover money you want to use for investing, then index funds should be the path you take. They may not be the sexy pick, but between lower fees, and lower risk, they’re the next step in accruing wealth. Simplifying your financial life isn’t about getting rich quick, rather learning how you can make money work in the long term, without the stress.

Free Resource:

All references in this article are opinions of the writer and are not specific recommendations for the reader. The writer is not a certified financial professional and is not giving certified financial advice.